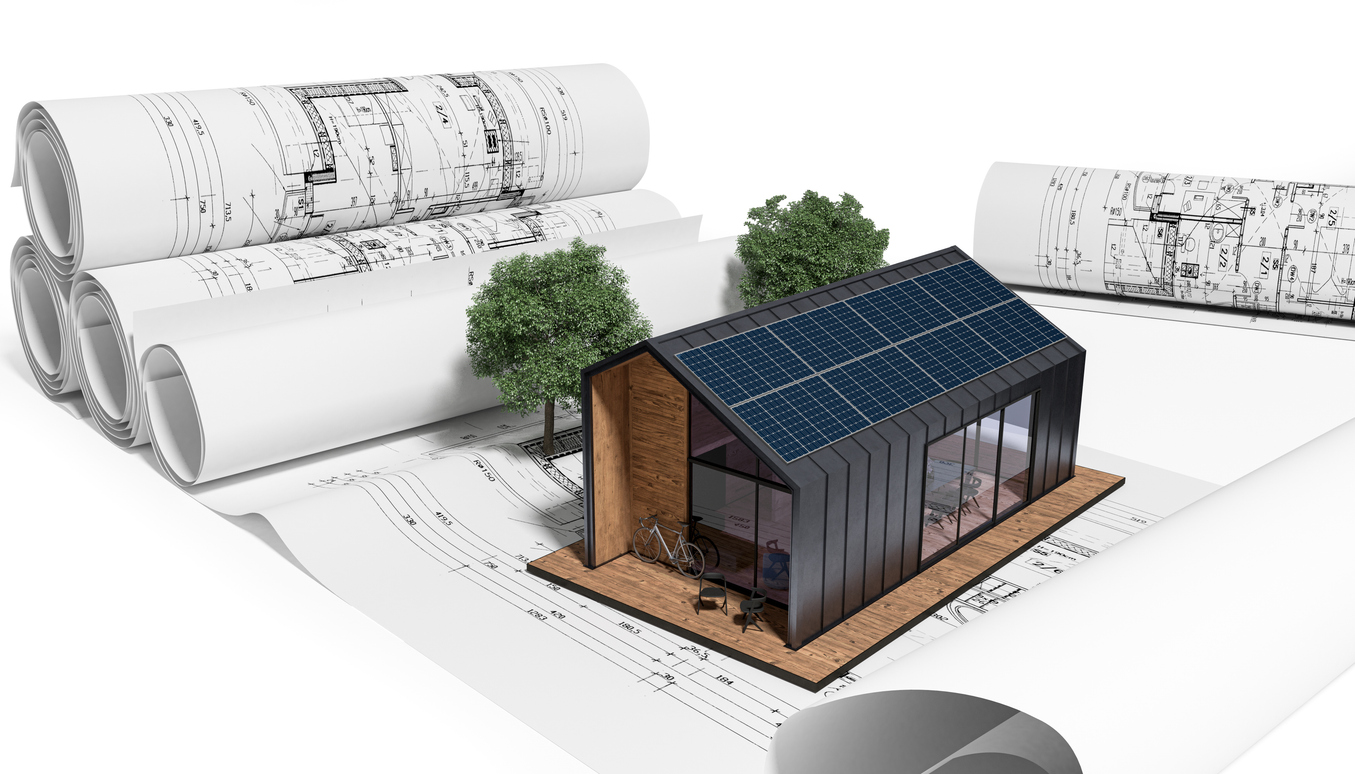

Accessory dwelling units (ADUs) are rapidly transforming residential landscapes, particularly in California, where housing shortages have driven a surge in demand for these secondary living spaces. In 2022 alone, ADUs accounted for 20% of home construction permits in California. This trend has gained national momentum, making it crucial for contractors to understand the unique liability risks associated with ADU projects and the importance of securing appropriate general liability insurance for contractors.

What Are ADUs and Why Are They Popular?

ADUs, often referred to as backyard cottages or converted garages, are secondary residential units built on single-family properties. These versatile structures address housing affordability and density concerns, offering homeowners an effective way to maximize property use.

Several factors contribute to the rise of ADUs:

- Housing shortages: In states like California, relaxed zoning laws and state-level incentives have made ADUs an attractive solution for increasing housing stock.

- Affordability: ADUs provide an affordable housing option compared to traditional home construction.

- Flexibility: Homeowners use ADUs for rental income, multigenerational living, or additional workspace.

This surge is reflected in nationwide trends, signaling a significant opportunity for contractors specializing in ADU construction.

Common Liability Risks in ADU Construction

While ADU projects present opportunities, they also expose contractors to unique liability risks.

- Property damage: Construction on existing residential properties increases the likelihood of accidental damage to landscaping, utilities, or other structures.

- Third-party injuries: Construction sites pose risks to homeowners, neighbors, or visitors, who may sustain injuries due to tools, materials, or equipment.

- Compliance issues: Failing to adhere to local building codes or zoning laws can lead to costly legal challenges and delays.

- Material and equipment liabilities: Defective materials or equipment-related accidents can result in significant financial and reputational damage.

Why General Liability Insurance Is Essential for ADU Contractors

Contractor general liability insurance for contractors is a vital safeguard for those working on ADU projects. Here’s why:

- Accident coverage: May protect against claims arising from property damage or third-party injuries

- Legal defense costs: May cover expenses related to defending against lawsuits or resolving disputes

- Client confidence: Demonstrates professionalism and reliability, often serving as a prerequisite for securing contracts

- Tailored policies: Addresses the confined spaces and other unique challenges of ADU construction with specialized coverage

Supporting Contractors in the Growing ADU Market

Insurance brokers have a pivotal role in helping contractors navigate this expanding market. Brokers can provide invaluable support to contractors in the ADU market by focusing on education, policy recommendations, and leveraging local expertise.

Educating contractors about their specific risk exposures, such as compliance challenges or site assessments, is crucial to ensuring they are prepared for potential liabilities. Recommending competitive, cost-effective general liability insurance policies that cater specifically to ADU-related risks demonstrates an understanding of their unique needs.

Additionally, brokers can build trust by showcasing their knowledge of state regulations and construction trends. This expertise reinforces their roles as reliable partners in navigating this growing market.

Protect Your Contractor Clients Today

The ADU market is booming, creating immense opportunities and risks for contractors. By securing comprehensive general liability insurance, brokers can help their clients confidently meet this demand while protecting their businesses.

Contact Commodore Insurance Services to explore tailored insurance solutions for ADU contractors.

About Commodore

Commodore Insurance Services, Inc. (Commodore) is a California corporation that operates as a Managing General Agency and Program Manager. Since incorporating in 1990, Commodore has developed an expertise in the production and underwriting of insurance products for businesses across the West Coast. Our focus is on providing top-level insurance products to our clients while striving to make it easy to do business for our brokers. Try us and find out why we have continued to be successful for more than 27 years and are recognized as the trusted leader in small business insurance.